How Real Estate Online Auctions Are Reshaping Property Deals in the US in 2026?

- By BidHom Team

-

Published on December 29, 2025

Published on December 29, 2025

7 minutes read

7 minutes read

On this page

- US property auctions shift from niche to mainstream sales

- Speed, transparency, and pricing accuracy fuel auction growth

- AI-led platforms set the standard for real estate auctions

- Auctions unlock faster liquidity for sellers and developers

- 2026 favors professionals who master the auction strategy early

Real estate auctions are no longer a niche corner of the US property market; they are becoming a serious transaction channel. According to industry data from ATTOM and major auction platforms, over 35,000 US properties entered foreclosure-related auction pipelines in late 2025, marking a double-digit year-over-year rise. At the same time, market research reports show that nearly one-third of auctioned properties now sell within 60 days, compared to traditional listings that often stretch beyond four months.

What’s even more telling is buyer behavior: more than 60% of active investors and owner-occupiers say they plan to increase auction purchases, driven by transparent pricing, faster closings, and growing confidence in online bidding systems.

It is anticipated that in 2026, auctions will become more strategic rather than “situational.” Analysts believe that auctions will play a far bigger part in residential, commercial, and even luxury real estate sales, since digital auction platforms currently handle well over 50% of all auction transactions, and AI-driven pricing, virtual property tours, and compliance automation are becoming commonplace. Auctions are positioned to become one of the most effective methods of determining genuine market value as long as inventory pressures continue and buyers demand clarity and speed.

For agents, buyers, sellers, and businesses, the true question is not whether auctions will increase in 2026, but rather who will comprehend them sufficiently to profit first.

Let’s break it all down in simple terms.

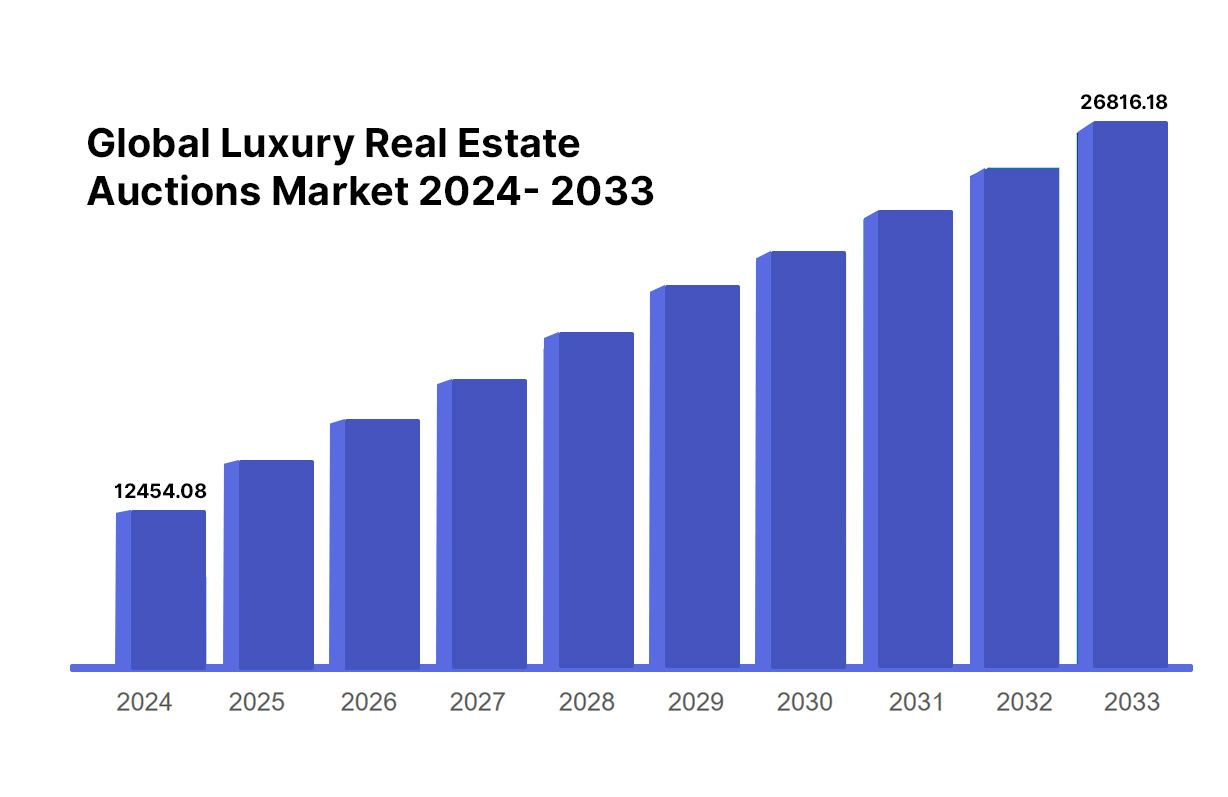

Luxury Real Estate Auctions: Global Market Overview

Before we dive into the US auction market, let’s take a quick look at some stats. The global luxury real estate auctions market is entering a strong growth phase, with its value projected at USD 12.45 billion in 2024 and expected to reach USD 26.81 billion by 2033, growing at a CAGR of 10.06%.

In 2024 alone, more than 27,000 luxury properties were sold through auctions worldwide, reflecting a 19% year-over-year increase as high-end sellers and buyers seek faster, more transparent transaction models. With an estimated 392,410 ultra-high-net-worth individuals (UHNWIs) globally, auctions are increasingly preferred to efficiently acquire or exit premium assets. Notably, nearly 31% of luxury auction transactions close within 60 days, a sharp contrast to traditional luxury listings that often take 120 days or more, reinforcing auctions as a speed-driven, market-responsive alternative.

The US Real Estate Online Auction Market: Where We Stand Today

The US real estate market has been navigating fluctuating interest rates, inventory constraints, and cautious buyers. Yet, property auctions are seeing steady growth because they solve three big problems: speed, transparency, and fair market discovery.

Industry reports show that:

- A growing share of distressed, bank-owned (REO), and even residential properties are now sold via auctions.

- Online property auctions have expanded buyer reach beyond local markets, attracting out-of-state and international investors.

- Digital-first auction platforms report higher engagement rates compared to traditional listings due to urgency-driven bidding.

What Is a Real Estate Auction?

At its core, an auction is a structured selling process where buyers compete by placing bids, and the property is sold based on predefined rules. Unlike traditional listings that rely on negotiations, auctions create price discovery through competition.

In real estate, auctions are used to sell:

- Residential homes

- Commercial buildings

- Land parcels

- Distressed or foreclosed properties

- Luxury estates

The biggest shift? Auctions are no longer chaotic or risky. Modern platforms bring compliance, data-backed pricing, and buyer verification into the process.

How Does an Auction Work? Step by Step

Here’s a simplified look at how most real estate auctions operate in the US today:

1. Property Onboarding

The seller lists the property with full disclosures, legal documentation, inspection details, and auction terms.

2. Pricing Strategy

A reserve price, minimum price, or absolute auction structure is selected based on market demand and seller goals.

3. Buyer Registration

Interested buyers register, verify identity, and submit proof of funds or financing eligibility.

4. Marketing & Promotion

The property is marketed across digital channels to maximize bidder participation.

5. Live or Timed Bidding

Bidders compete in real time or within a fixed auction window.

6. Winning Bid & Contract

The highest qualifying bid wins. Contracts are executed digitally, reducing closing timelines.

Types of Real Estate Auctions You Should Know

In the given section below, we will discuss the types of real estate auctions.

Core Bidding Mechanics

- Classic Online Auction: The highest bid wins once the auction closes.

- Highest and Best Auction: Buyers submit their strongest offer by a deadline, ideal for high-demand markets.

- Dutch Auction: The price drops incrementally until a buyer accepts.

- Reserve Auction: The property sells only if bidding meets the seller’s minimum price.

- Sealed Bid Auction: All bids are private, reducing emotional bidding.

- Absolute Auction: The property sells to the highest bidder with no minimum price, highly attractive to buyers.

- Minimum Auction: Bidding starts at a fixed minimum value set by the seller.

- Reverse Auction: Sellers compete to offer the best price to a buyer or organization.

Technical & Delivery Formats

- Virtual Auctions: Fully online, accessible nationwide

- Timed Auctions: Countdown-based bidding for urgency

- Live Stream Auctions: Physical auctions streamed online

- On-Demand Auctions: 24/7 bidding without fixed schedules

Specialized Property Auction Types

- Distressed & foreclosure auctions

- Short-sale auctions

- Bank-owned (REO) auctions

- Government and tax lien auctions

- Commercial and land auctions

- Luxury property auctions

Each format serves a different buyer profile, from first-time investors to institutional players.

What’s Fueling Auction Market Growth?

Several factors are accelerating auction adoption across the US:

- Digital-first buyers are comfortable with online transactions

- AI-driven pricing tools are improving valuation accuracy

- Faster closings, often 30–50% quicker than traditional sales

- Increased transparency, reducing disputes

- Wider buyer reach, especially for unique or high-value properties

Agents and brokers are also embracing auctions to stand out in crowded markets.

Technology’s Role in Auctions Heading Into 2026

By 2026, technology will be deeply embedded in how auctions operate:

AI & Machine Learning

- Predictive pricing models

- Smart bid recommendations

- Fraud detection and bidder scoring

Blockchain

- Immutable bid records

- Transparent transaction logs

- Faster, more secure settlements

Virtual Property Tours

- 3D walkthroughs

- Digital twins of properties

What Can Happen in 2026? Key Predictions

Based on current market data and adoption trends:

- Online auctions will move beyond distressed assets into mainstream residential sales

- Luxury and commercial auctions will grow faster than traditional listings

- Enterprises and developers will use auctions to liquidate inventory efficiently

- AI-powered auction software will become the industry standard

- Trust in auctions will increase as compliance and transparency improve

Why Auctions Matter for Agents, Buyers, and Sellers

For Agents & Brokers

- Faster deal cycles

- Higher engagement

- Data-backed pricing confidence

For Buyers

- Transparent competition

- Fair market pricing

- Access to exclusive inventory

For Sellers

- Reduced holding costs

- Market-driven prices

- Predictable timelines

Final Thoughts

In 2026, real estate auctions won’t be about hardship or desperation. They have to do with technology, efficiency, and trust. Auctions are turning into a wise, calculated choice for all parties engaged in real estate transactions as the US market develops.

By combining smart technology, transparency, and user-friendliness, platforms like BidHom are contributing to the modernisation of the auction process. They are making real estate auctions more dependable, accessible, and prepared for the future.

Now is the moment to comprehend auctions as a potent strategy rather than a fallback if you’re a realtor, buyer, seller, or business trying to stay ahead.

Share Article